Most Importance of Credit Cards No Foreign Transaction Fee

Before you sign up for any credit card, make sure that it has No Foreign Transaction Fee. No Foreign Transaction Fee is the single most important feature that makes a credit card worth bringing along with in your travels. Fortunately for all of us, there are many credit cards with No Foreign Transaction Fee with zero annual fee so this feature is easily obtainable.

The Importance of No Foreign Transaction Fee

A no foreign transaction fee is important in a credit card for traveling because it allows you to use your card outside of your home country without paying an additional fee. Foreign transaction fees are typically charged by credit card issuers as a percentage of each purchase and can range from 1% to 3%. This can add up extremely quickly, especially if you’re making a lot of purchases while you’re traveling. Imagine buying a cup of coffee, museum tickets, purchasing souvenirs, gas, and other purchase only to be hit with unnecessary foreign transaction fees.

Three Benefits of No Foreign Transaction Fee

Here are some of the reasons why a No Foreign Transaction Fee is so important in a credit card:

- It can save you a lot of money. If you travel frequently, a No Foreign Transaction Fee credit card can save you a lot of money on foreign transaction fees no matter where you are. Even if you don’t travel often, why not save money by eliminating foreign transaction fee? For example, if you spend $1,000 on a trip to Europe and your credit card charges a 3% foreign transaction fee, you’ll pay an additional $30. That $30 could have been spent on memorable things like a delicious lunch or amusement park tickets.

- It gives you more flexibility. With a no foreign transaction fee credit card, you can use your card anywhere in the world without having to worry about paying an additional fee. You will enjoy travel more when you have less to think about and less calculation going on in your mind. This gives you more flexibility to travel and spend money where you want, without having to worry about the extra cost.

- It’s more convenient. It’s simply more convenient to use a credit card with No Foreign Transaction Fee when you’re traveling. You don’t have to worry about converting your currency or paying additional fees. So go ahead and swap your dollars for yen, euro, rupiahs at the nearest ATM without additional pesky fees.

| Purchases | Credit Card with 3% Foreign Transaction Fee | Credit Card with No Foreign Transaction Fee |

| Hotel for 5 days | $515 | $500 |

| Train Tickets | $61.80 | $60 |

| Lunch at Cafe | $15.45 | $15 |

| Eiffel Tower Tickets | $30.90 | $30 |

| Grand Total | $623.15 | $605 |

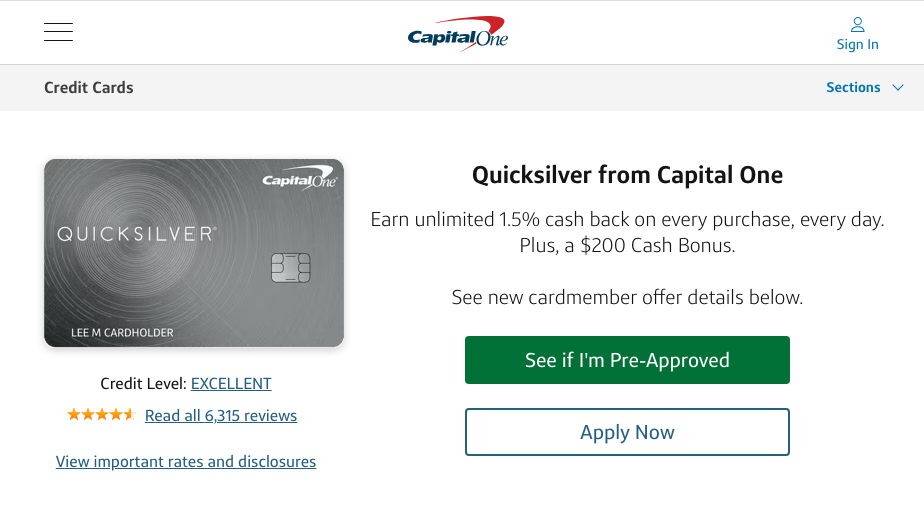

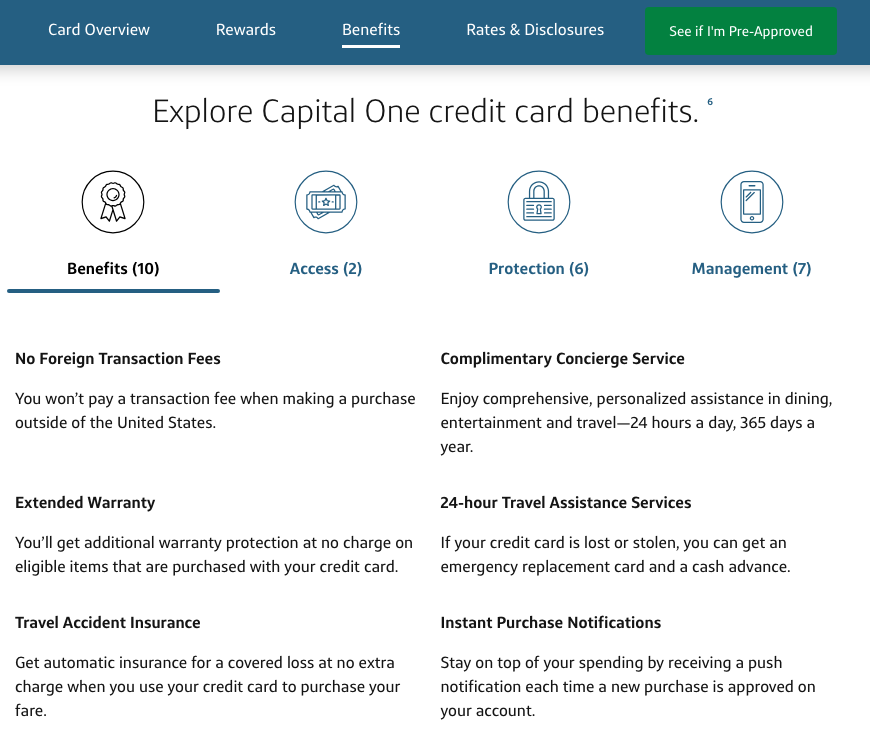

Example of A No Annual Fee With No Foreign Transaction Fee Credit Card

An example below is the Capital One Quicksilver MasterCard. This credit card has No Foreign Transaction fees and because it’s a MasterCard, it is widely available no matter what country you visit. Click here to find out more about this card.

The second important requirement recommended is to make sure the credit card is either a Visa or MasterCard. Both are widely used around the world based on my personal travels, but this topic will be talked about later in another post.

Conclusion

If you’re planning on traveling internationally, I highly recommend getting a credit card with no foreign transaction fee. There are a lot of No Annual Fee ones out there such as Capital One’s QuickSilver Mastercard that is great for starters or people who love to save money. Eliminating Foreign Transaction Fee one of the best ways to save money and make your trip more convenient. You will enjoy your trip much more when you don’t have to think about foreign transaction fees eating away at your money. For important on which countries are safe to travel, click here.